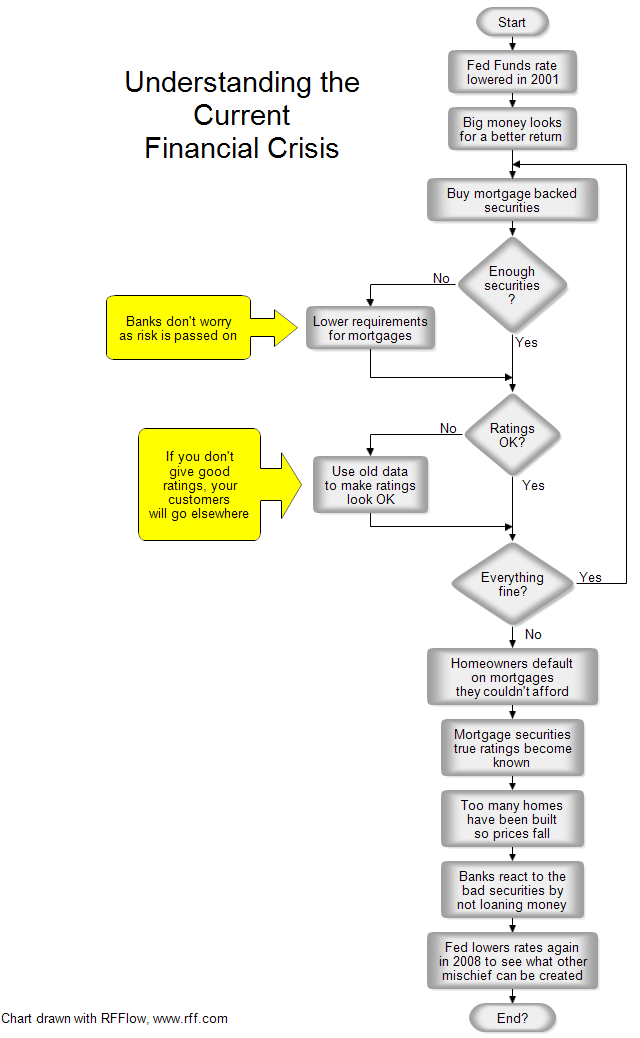

This flowchart tries to explain the basic points in the current mortgage crisis.

The story is probably an old one. People try to get the maximum return on their

money. Big returns have big risk. Investors may not have realized this, but the

risk was there. The two yellow boxes in the chart above show where regulation

failed. Normally a bank wouldn't give a loan to someone who had no income and no

assets and such mortgages combined together should not have a high rating. By

elevating these toxic mortgages to triple A an enormous amount of wealth was

generated. However, this wealth disappeared when their true value was

determined. This will all happen again, but in a different way.

If you haven't already done so, first

download the

free trial version of RFFlow. It will allow you to open any chart and make

modifications.

Once RFFlow is installed, you can open the above chart in RFFlow by clicking

on

foreclosure.flo.

From there you can zoom in, edit, and print this sample chart. It is often

easier to modify an existing chart than to draw it from scratch.

To draw this chart without downloading it, run RFFlow and use the Sample

Stencil.